Episode #13 - Do non-profit workers get to retire?

Hint: More likely if they follow what is outlined in this letter...

Intro:

Welcome back! Great to have you onboard the Winnings train. We’re still taking responses to our first-ever anonymous Winnings survey here. It will close by July 31, 2020 - so please take five seconds to fill it out and we’ll have a better sense of our community of readers.

Just as when I started this project, the goal of this letter is to encourage/coax/convince you to invest in your retirement, understand the process, and share with the community what you’ve achieved or what you hope to achieve. We’re still in the early stages, but I would love to hear from you if you’ve taken any action over the past episodes. Drop a line by responding to this email to share an update of any kind.

This week, please scroll to the end as we have a reader question about switching jobs and 401(k) that might clarify something for you.

On to our episode: While last episode focused on the the 401(k) as a retirement vehicle, I wanted to take this episode to zoom in on another instrument with a similar 40X(Letter) name: 403(b).

Background:

Up until recently, non-profits, public schools, and a few other groups were not able to offer 401(k) plans to their employees. Instead they would offer a 403(b) plan, which remains as the main retirement option offered to people working in these sectors.

A 403(b) plan works in a similar way as the 401(k) plan - i.e. not every organization offers one, there are some rules about when you may start contributing (eligibility rules for example, some orgs will only let you contribute after working for a year or two), and some organizations provide a “match” which means they will add to what you contribute from your salary.

Data:

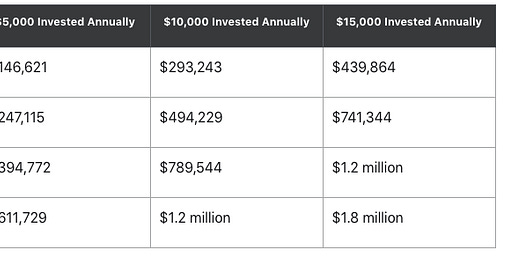

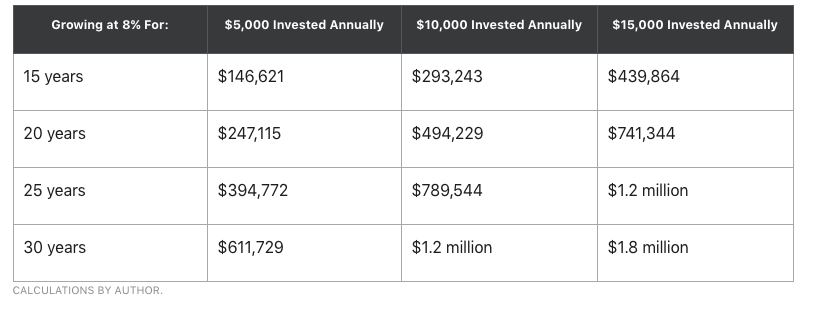

According to research cited by the Motley Fool 79% of Americans have access to 401(k) or 403(b) plans, but only 41% take advantage of it. Based on the early results of the survey, few of you take advantage of these tax deferred accounts. This chart does a lot of the work about why starting to save with any retirement account immediately makes a significant difference:

(Chart sourced from this article and the “author” is the author of the linked article, not me)

When you double the number of years your money is invested from 15 to 30 you get nearly 4x the growth in the market. This is a straight forward example that illustrates the time-value of money and why setting aside pre-tax dollars in an IRA or 401(k)/403(b) asap makes a significant difference.

A little more data from our friends at CNBC regarding the percentage of American’s that are putting money away for retirement (numbers based on a Pew study):

41 percent of millennials didn’t have access to an employer-sponsored retirement plan while only 35 percent of Gen-X and 30 percent of boomers had to do without.

52 percent of millennials with plans available are making contributions. In contrast, a full 80 percent of boomers and 75 percent of Gen-Xers are.

Finally, a note for those who are still on the “younger” side of the spectrum, I thought this quote highlights the importance of acting now:

Although 24-year-olds have time to bounce back if, for whatever reason, they aren’t saving and investing yet, it’s still important to begin developing smart habits early. Kimmie Greene, money expert at Intuit and spokeswoman for Mint.com, says the most important thing to do money-wise in your 20s is to develop a willingness to have tough conversations with yourself and make sacrifices in the name of financial health.

All in all, a chance to get tax deferred benefits today should not be missed.

Rewards:

The advantage of both the 401(k) and for our specific purpose today the 403(b) is the fact that the contribution limit is many times higher than the maximum of an IRA. With these 40X(letter) plans you can put away nearly 20k/year, while the IRAs are currently limited closer to $6,000.

Because these plans are typically baked into larger financial institutions, you’re not taking the risk that the organization you work for takes a hit that will impact your 403(b) plan.

These plans typically come at a low cost and you can request that you’re put in the most aggressive plans to match your age and when you plan on starting to take money out of the account.

Risks:

The risks here are more of an eye-catcher and an encouragement to do due diligence on the plans you sign up for. For further discussion check out this article.

There are some retirement plans through 403(b) that have high costs or slimey sales-reps trying to get you to buy them (again with a “bad deal” in front of you). I don’t know the odds of this being the case, but as with any financial investment, you should take the time to research and ask questions to colleagues and other people at your organization and compare it to other options you have at hand (i.e. investing in your IRA with more flexibility because you choose where to invest the money).

The last risk has to do with Employee Retirement Income Security Act of 1974 (aka ERISA, rhymes with Melissa). This certification can be obtained for 403(b) accounts, but it is not required (whereas it is required for a 401(k) account). This safeguard puts in minimum standards of protection on the investment package and puts in some responsibility for communicating how the money is being invested and when things change. This Act extends beyond the investing side and if you’d like to look into it further to see how it protects you, check out this article here.

Takeaway:

We’ve covered IRAs (Roth/Traditional), 401(k), 403(b), and we won’t cover the 457 plan (for government workers, mainly). At least one of these plans (at the bare minimum the IRA) is accessible to you if you have some spare money to put away.

To fulfill the mission of this note, I’d like you to takeaway from this episode the proposition of the time-value of money simply outlined in the chart above. The sooner you get into a suite of offerings in the market, the more likely you’ll get a chance to build up savings to support yourself after you are no longer able to work.

Interact:

Have you been thinking “I just haven’t done this whole investing/saving thing yet, but I want to!” How about this - just respond to this note and say “I commit to investing in my financial health” and you’ll get a personal follow-up email in two weeks to see how it’s going. No charge, no scam, just a nudge.

This is for you commitment-phobes and people who want to retire. Consider yourself nudged.

Gratitude:

Thank you to Tova P for piping up with a question from the last episode: “Thank you for this great newsletter! I thoroughly appreciated it. Here is my question: if you know you might work at a bunch of different places, do you set up 401K accounts at each one? Or have it moved when you move jobs? I am confused about this part.”

This is a super important question, Tova! First off, in each place you work you would need to opt-in to the 401(k)/403(b) program, it is not automatic. When it comes to switching/moving/rolling over your accounts, as you might imagine, the answer is “depends.” It relates to how much the fees for the 401(k)/403(b) are in the account at your current workplace and what they would be at the new place. Sometimes having more money in an account will actually lower your total fees, which could also make a difference. Laura Morganelli touches on this topic in her blog here.

Thank you to Gail Weinberg for editing this issue of Winnings.

Have other questions? You can respond to this email directly, or drop a comment: