Episode #14 - Bonds, Mr. Bonds

An ode to the secret agent and a reflection on your portfolio diversity

Intro:

Welcome back! Also, welcome first timers! Our small community continues to grow (we’ve cleared 150 members) and thank you for signing up. Today might be your first or your fourteenth Winnings, regardless I hope that it serves as a source of useful information for you as you go about your life considering your financial health.

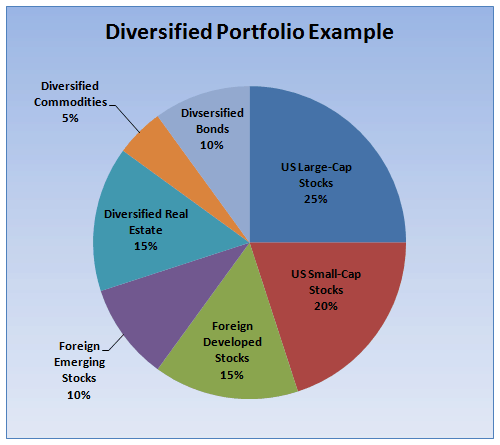

In Episode #5 I discussed the value of diversity in your portfolio and I promised that I’d discuss the different groups represented in this lovely pie-chart:

In past episodes we’ve covered “small-cap” and “large-cap,” so today I’d like to make good on that promise by discussing bonds.

Go ahead, read on.

Background:

For the hat-tip to history, according to bondfunds.com the oldest bond was issued in 2400 B.C. - where the currency at hand was corn. For those with digestive challenges or if you’re not sure why corn was worth something - you’ll need to read a different newsletter.

Bonds were used not only by private companies but by governments to raise money to support exogenous events - like war - to fund the effort from the generosity of it’s citizenry or others beyond its borders. The first of it’s kind was launched by England at the close of the 17th century and governments have been doing this ever since. Some people get bonds as a gift at birth or for their bar/bat mitzvah. The bonds often reappear when a kid leaves the house and the parents try to get rid of all the documents related to the child. At those moments, bonds usually leave people in their early twenties confused as to what they are and if the quirky $100 with some guy wearing a wig is actually worth real money.

They are.

How does this bond thing work?

The most simple version of the stocks vs. bonds dichotomy would be this:

When you own a stock, you own a part of a company. When you own a bond, you have given a loan to the company, government, entity, etc.

Your bond gets you interest payments (usually twice a year) and then a full pay-out at the maturity date of the loan. A stock, as you’ve read in the past, will usually earn you money if you get a dividend or when the value goes up AND you sell the stock (if the value goes up and down and then you sell it, you don’t make any money). The bond works more like clockwork, boring to watch, but if the company/government has the money to pay, you’ll continue to earn money.

To quote The Street:

While stocks are a stake of ownership in a company, a bond is a debt that the company or entity enters into with the investor that pays the investor interest on that debt. Essentially, bonds are IOU's that companies enter into with investors on the pretense that they will repay the money lent in full with regular interest payments.

As you may have surmised from the opening salvo of this section, bonds take a number of different forms:

Treasury Securities - There are a few different types of these. Their maturity date ranges from 30 days to 30 years. These are typically the highest rated bonds in the the USA because they are backed by the federal government. Because of their secure status they typically have low interest rates. The other upside is that they are exempt from federal and state taxes when they mature!

Municipal Bonds - Known affectionately as “munis.” These bonds help fund state and local projects (think roads). They are also exempt from federal taxes and will sometimes be spared state taxes too.

Corporate Bonds - These are typically less secure and sometimes can be “junk bonds.” Because they come with more risk, they will often have a higher payout of interest and be sold more actively on the market.

If you can’t get enough of these bonds and want to learn more, check out this link.

Takeaway:

Part of the power of this is from the world of “knowledge is power.” You now know that bonds provide you more diversity in your portfolio because they are traditionally more secure. (There have been bond crashes, but that’s why you don’t go ALL IN with bonds either.) As you construct your portfolio, you should ask yourself - what types of bonds have been sent my way? What risks do they have baked into their DNA? Are they more safe or less safe than other equities I’m invested in?

Interact:

If you have a portfolio of any sort, please check them out and see what bonds you have in your portfolio. Send me a note with just one of the bonds and take a stab at how “risky” you think it is. We talking Treasury? Muni? Corporate? Something else?

If you don’t have a portfolio yet or any bonds in your portfolio, why don’t you google US Bonds and see what bonds you might want to get for yourself?

If you have a bond from some earlier point in your life, check out what type of bond it was and then cash it in!

Gratitude:

Thank you to the brave cadre of readers who pushed this list past 150 people. Now it’s time for our next goal: 500 subs by the close of 2020! Help us get there by clicking below and sharing the post with your networks: