Intro:

Have you ever said to yourself: “I wish I could invest in real-estate?”

Even if you have not, you likely have seen someone on LinkedIn involved with CRE (commercial real-estate) or you’ve met someone who ambiguously says “I work in real-estate.” Whether you are one of those people or have imagined those people in the past, what would you say if I told you that you can invest in real-estate yourself?

Real-estate, in the spirit of defining our terms, comes in the form of land and any other investments made into the land to improve it. (Think the white picket fence from the American dream or the awesome in-ground sprinklers primed for summer fun.)

I’m bringing us to REITs (aka real estate investment trusts and pronounced “reets”) because they 1) should be a portion of your grander portfolio (see the pie from last episode) and 2) they get you quite close to owning a piece of land without needing to figure out what to do when there is a power outage.

Put simply, a REIT is a company that owns or operates income producing real estate.

Background:

Apparently over 87 million Americans invest in REITs mostly through their retirement funds (think 401k plans). Do you know if you’re in any REITs yourself?

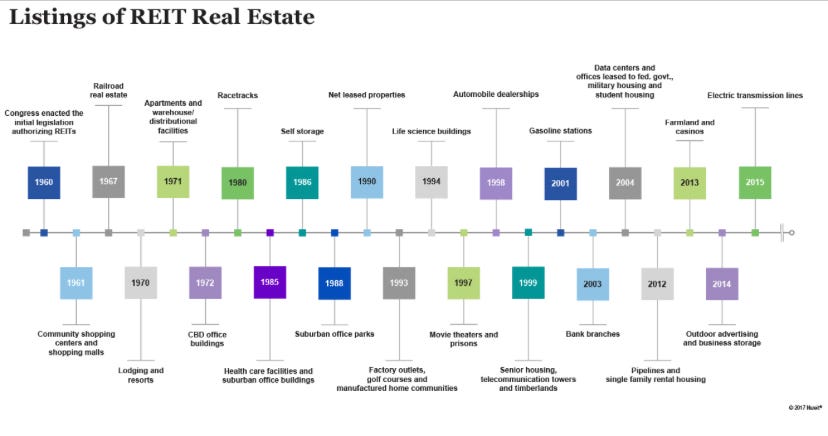

For the history you usually look for here, I’ve got some for you on REITs. They were established by Congress in the 1960s to enable individual investors to reap the benefits of a real estate investment as a sort of real estate and stock hybrid. Since President Eisenhower signed the bill into law, tens of different real estate categories have joined the fray, from automobile dealerships to movie theaters (and prisons too).

Take a close look at this graphic and you’ll see just how many different places your real estate investment can land with a REIT.

Until REITs hit the scene, a non-wealthy individual could not own a piece of property and gain income from rent or collecting mortgage payments - or at least took a lot of money saving and a high financial risk. Practically, REITs revolutionized the way an individual could play the real estate market.

Who taught me this idea?

One of my investment teachers, Yosef L., introduced me to REITS nearly 10 years ago. I was on an investment kick and I was hoping to figure out a way to buy some land and collect rent. He was a student in a business school and I was an English major, so I quickly listened to his guidance and found out about the power of REITs.

There are three types of REITs that are most commonly used:

Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. Revenues are generated primarily through rents (not by reselling properties).

Mortgage REITs. Mortgage REITs lend money to real estate owners and operators either directly through mortgages and loans, or indirectly through the acquisition of mortgage-backed securities. Their earnings are generated primarily by the net interest margin—the spread between the interest they earn on mortgage loans and the cost of funding these loans. This model makes them potentially sensitive to interest rate increases.

Hybrid REITs. These REITs use the investment strategies of both equity and mortgage REITs.

(Sourced from the crew at Investopedia)

Your knowledge of these categories will help you understand the investment summary sheet that your investment company sends you. It will also help when you compare investing plans.

Takeaway:

An important thing to remember when it comes to REITs is that there can be REIT fraud. So while there are 200+ publicly traded and SEC approved REITs, I encourage you to avoid REITs that are put out by private orgs without a higher authority’s seal of approval.

similar to stocks, you can invest in individual REITs as well as ETF REITs (Ie a collection of these different companies - there is always a way to be more diverse), there are even mutual fund REITs!

The biggest advantage of the REITs is the presumed consistency in the field. Remember the presumption is that people will pay their rents and then the REIT owners will get some portion of that fee — and if you’re one of those invested, it goes to you.

The other REIT advantage is that they are liquid assets - meaning you can sell them at will and receive market value to keep in mind.

Interact:

First, if you have REIT in your portfolio, please email me to let me know. If you don’t, please email me to let me know that too! I’m trying to get a sense for where folks are in the community.

Additionally, this week I have an external financial literacy quiz that compares you to the rest of the USA and to different states. It presumably will be fun to see what you know now, whether this is your first or last episode of Winnings, or something in between. Take the QUIZ! (5 questions totally anonymous)

Whatever your score, please share it with the community via email directly to me so we can see where the community is on financial literacy. Once you’ve taken it, or just do it now, please share this episode with a friend!

Finally, I’ve mentioned this resource before, but the Morning Brew gives a daily down to earth take on the news. I highly recommend it and will receive an excellent dose of important info daily. I would sign up now here if I were you. (Full disclosure I get a mug if you sign up.)