Episode #19 - Robo-Advisor Showdown

Keep on liking and sharing - great for my ego and helps others find the notes!

Intro:

Welcome back! If it’s your first visit, you should check out last episode (#18) to see a little more about my general thesis around this letter. Reader David L pointed out Public.com as a group doing something similar to what I’ve laid out, and I hope they succeed. I joined to see how close it is to my vision of the problem. I do hope that you’ll soon be able to share your saving-milestones in our #Winnings Slack group. Stay tuned for the launch of that Winnings product I mentioned.

In today’s issue I’m doing a deeper dive into Betterment vs. Wealthfront the two leading robo-advisors, the links are both to my “share” account, I do get some extra 💰 managed for free when you use these, but more importantly it shows me that someone has actually followed some of the advice I’ve put out into the world in this note.

I utilized some of the work summarized in Nerdwallet and will give some commentary based on the linked article. I recommend taking a peek at it at some point to build out your knowledge on the topic.

Background:

As discussed in the robo-episode, Betterment was actually first on the consumer-facing-robo-advisor scene (a multi-billion dollar scene right now). This meant that people like you and me could benefit from the algorithms that churn up ideal investment portfolios to match the user’s risk. This was something higher net-worth individuals were able to use for a while but it finally went rogue to the masses.

In this issue it’s up to you to decide where you’ll drop your robo-advised dollars.

Setting the scene:

Because the odds of you clicking on the Nerdwallet article is super low (I see the click-rates) I’ll loop in Arielle O’Shea’s version of TL;DR:

The biggest deciding factor at this point: If you want to work with a human, you’ll find that option only at Betterment. If you’re after only digital advice, Wealthfront’s offering may be more robust.

In short: Betterment has a premium option to get you to a human, while Wealthfront gets you more robust offerings as you add money into your account.

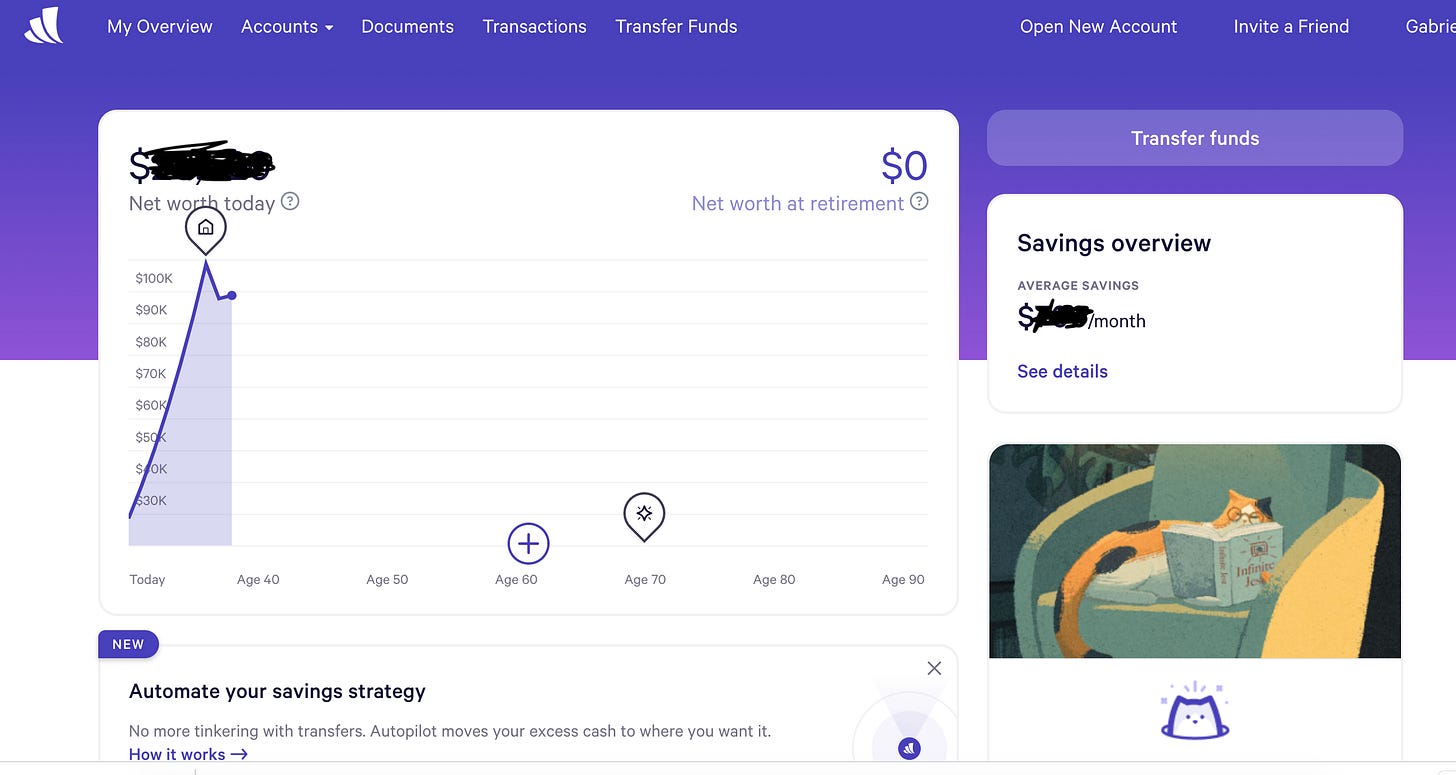

Here are photos from the desktop version of these apps so when you sign up you’ll be less surprised at to what they look like:

Wealthfront.

Betterment.

What takeaways to you have from the homepage? (Reply with emails or in the comments below)

Apologies if you’re reading on mobile and are having a harder time seeing the pictures. The general upside of either of these platforms is that they will pester you more often than me to put away money and then they will invest it for you - they have the IRA/Roth IRA capabilities and you can even roll in your 401(k)’s in most instances. The systems can also incorporate other accounts you have by just logging in to them through the app. This feature helps you see as close to a big picture of all of your finances as possible - a few different apps do this, but doing it in the robo-advisor systems will help you get as broad a picture as possible (barring any investments that don’t have a login compatible with Wealthfront/Betterment).

Betterment has $0 minimum deposit, while Wealthfront needs you to put in $5,000 to start. The upside of the $5,000 is that you’ll already be investing when you start as opposed to the allure of starting with $0, but then be actually saving zero. If you know thyself and don’t think that will change things for you, I would see the argument behind going for Betterment on this feature alone.

A little on flexibility and options: Betterment offers a premium plan that offers human guidance, a feature Wealthfront doesn’t offer. On the flip side, Wealthfront has a built in option for a 529 plan (I will cover 529s at some point soon), in short it’s a college fund for your children. Going with Wealthfront means betting on robots while Betterment leaves a clear option for human interaction within the app.

If you’re looking for more options in the world of robo-investors, check out this link.

My insight:

Here’s my take. One of the challenges of getting rolling on the investment train is keeping track of the different items in your, ideally growing + diversifying, portfolio. For example, you might start now with Wealthfront because you’re bullish on robots, and then you strike it rich and want to talk to someone and pay a bit extra for that luxury. You can transfer money out of these systems, it just might be a bit of a pain, and you will lose whatever “mix” the algorithm was giving you.

To clarify, right now I’ve got $XX dollars in Wealthfront, but if I want to transfer into a different account my money that is in the market would first need to go to cash before I can reinvest it in other equities. This is opposed to when you invest in, say, Robinhood and you can directly transfer your ownership of a stock or ETF directly into another brokerage house.

Feature obsession may lead you in the right direction, but remember if there is something you want that your current robot does not have you can go elsewhere. (Betterment has the same money transfer rules, which you can review in the literature here.)

Takeaway:

Ok. So which one? The answer is yes. Find one to start with and then move on from there while continuing to keep track of where you’ve hidden/invested your money.

Full disclosure, I actively use a Wealthfront account, but I think you’ll be similarly successful with Betterment as long as you keep on your toes every year or so to ensure that you’re on track with the goals you put into the robot when you first started and at each point that you update.

Gratitude:

Thank you to the five souls who “liked” the last post - they are listed on the site when you click “like.” Thanks do Dan H. for suggesting more research into social money items through looking at Venmo, I’ve still got deeper to go there, and again to David L for suggesting Public.com - from what I’ve seen so far it’s a super cool place, thought I worry it focuses too much on individual stocks and won’t build great investing habits. I will check it out more carefully before I give it a full review!