Intro:

In the last two notes I’ve gotten a chance to cover some of the upsides of Mint. Mainly reviewing it as the “one-stop-shop” for all of your accounts and an overview of it’s budgeting tool. I’ve gotten a fair number of questions and feedback regarding some of the drawbacks of Mint, and I thought it would be good to spend some time in this episode discussing those items. Knowing what works and doesn’t will hopefully help you evaluate your options - and perhaps you know and can share a tool that you’ve found that works better than Mint.

I’m going to do this in two episodes, so if I don’t hit your gripes in this episode comment or share yours with me directly and I’ll rope them in on the second time around.

To make sure you get the next episode sign up here:

Background:

The premise of Mint is that you can keep track of all transactions, finances, and more in one place. I’ve actually gone back through 49 PAGES of transactions and found my first record in Mint here:

Yes, way back at the close of 2012!! Where were you then? Just think about that for a minute.

The allure of a one-stop-shop for tracking personal finance still strikes me as a valuable tool. I’ve got some notes for you about Mint’s weaknesses and I’m hoping you share yours. In the long term, I want to put together these pain points to build and share with this group a tool that functions better.

The Weaknesses:

In this episode, I cover three limitations: (1) linking, (2) ads, and (3) budget automations.

Linking - I’m pretty confident that the most common critique of Mint is the fateful moment when your account confidently informs you “Something’s up with this connection.” My internal response is “You had one job!” I will then try to figure troubleshoot the problem, often leading me to change password of one of my myriad accounts and ultimately it gets reconnected, but boy is it a pain.

Advertisements - As one of my teachers in the world of business reminds me, when a product is FREE you are the product. That certainly holds true for Mint - the number of ads, for the same thing, is shocking. How many times can the AmEx dude in a metal helmet try to convince me of joining the elite AmEx community. It would be nice if they could at least see that I HAD an AmEx and got rid of it because I thought the fees were annoying.

This is not a real ad as I didn’t include the affiliate link - remember, if the product is free YOU ARE THE PRODUCT. h/t Prof. Galloway This bleeds into each part of the app. You even have this handy disclaimer across the whole site.

Budgeting Automation: Two things are challenging in the world of tracking expenses:

The Mint system does a solid (albeit limited) job of guessing what your expenses are for, but sometimes it just misses the boat. This yields a need to do a careful job of recategorizing many of your items. If you remember to do this each month, you’re a champion.

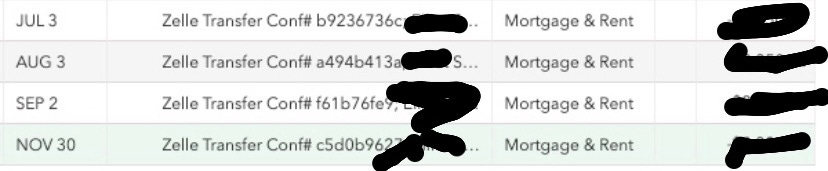

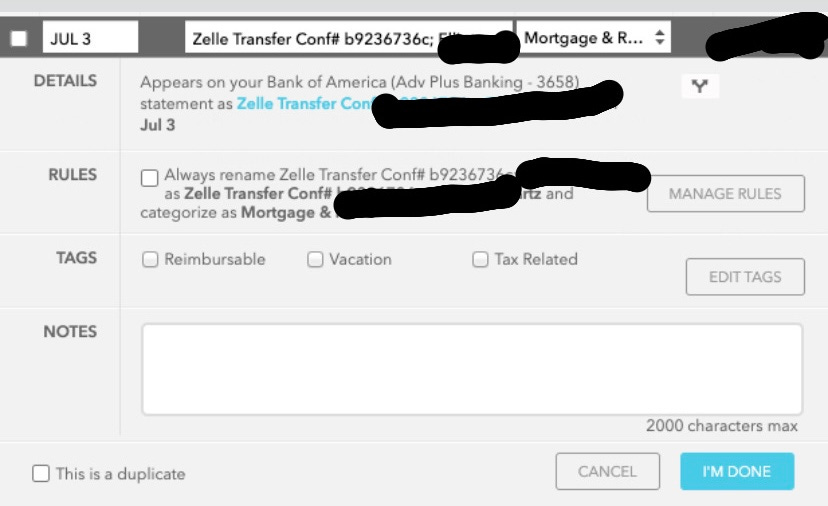

You then have a second problem - when you want to create an automation - for example any payment with part of the same name should be categorized in the same way (see the example below). However, it only allows this to work with an exact match. This was an issue when I tried to get the system to recognize my rent payments. To make it categorize the same way the name must match 100%. The system with which I make the rent payment generates it’s OWN UNIQUE NUMBER EACH TIME.

A little known hack is that you CAN make rules for what should be categorized in which system, but it is a limited skill as you can see here:

If I could make a rule that if the system has a payment that includes “Name of my landlord” that goes directly into the “Mortgage&Rent” category, that would be perfect. However, the system doesn’t take those nuanced rules which yields the current outcome of “a pain.”

These are not meant as whiny reflections, rather I’m trying to point out the opportunities for significant improvement of the application that would go a long way. Practically, I’d pay for it if it works. Would you?

Interact:

Do you use Mint? Have you considered it? I would love to hear your gripes, why you stick with it, what you’ve used as an alternative?

Gratitude:

Thank you Adam N. for sharing your gripes/challenges with Mint, and I hope you folks reading take a few moments to share your challenges so we can keep collecting the limitations and opportunities for improving the interface of our personal finance tracking. Next week I’ll feature Jared M’s take as well as other items I’ve got on my personal list. Thank you Gail W. for your help with proofing this episode!

I have heard good things about the "YNAB" software as a similar product without the ads - but it has a monthly subscription cost.