Episode #33 - Credit Cards Part Two

In the Pre-Tax Corner we tackle "Can I deduct my home office?"

Intro:

Last week I provided a fair amount of background and baseline info about why you should have and use a credit card. This episode has three goals: (1) show you the pieces that go in to applying for a credit card, (2) provide you some general tips about which credit card you should get (mostly culling from other useful sources), and (3) some warnings/risk analysis for what happens if things don’t go well upon your application.

Process:

Let me be clear, there are MANY credit cards and if you don’t have one as of yet you’re in a bit of a catch-22 (reminiscent of the job application catch-22, you need a job to get experience to get the job…). If you lack credit history, the credit card companies have nothing to base the likelihood that you will make your payment on time. This will certainly make getting a credit card more difficult.

The cards that are most accessible to those without a credit history or with a poor credit history are called “secured credit cards.” These cards, simply defined from NerdWallet, have the following traits:

Secured credit cards require a cash security deposit, while regular "unsecured" cards do not. The card issuer requires that you deposit some money — typically $200 or more — to open your secured card account. The deposit is there to protect the issuer in case you don't pay your bill. Because secured credit cards pose less risk to the issuer, they are generally easier to qualify for.

For most of these secured cards, you get your deposit back when you close out your account - perhaps when you’ve built up enough credit to qualify for an “unsecured” card in the future. These secured credit cards are a relatively clear way to build credit.

Another way to build credit is to be named an “authorized user” on the credit card of a family member, but you need to make sure that the system is tracking that you’re on the card. If this information isn’t being tracked, it’s unlikely that the system will count any credit you’re building through this process.

Credit card applications are generally pretty straightforward. They ask for your name, social security number, address, annual income, other assets you have in your name and so forth. Check this one out below:

The moment you’ve been waiting for, which card to get. I’m just not positioned to give you the specific cards at this stage in the game. I recommend reviewing WalletHub’s collection of credit cards that have minimal, if any, credit history requirements for applicants.

There are a few other things you should look out for on these credit cards:

What is the APR/Interest Rate? Look at what the card on offer has before you sign up for it - it’s good to know how much in the hole you’ll be if you miss a payment.

How often do you need to pay the card off? (Usually this is monthly, but sometimes there are minimums you can pay to stop interest from accruing.)

What’s your credit limit? This is going to tell you how much you’ll be able to spend on your credit card before paying it off. (You can get extensions of your credit line as your credit improves!)

What’s the catch?

As with any application, I’m certain the risk of getting rejected has crossed your mind, and it should! It can certainly happen. The folks at Experian lay out a 4 minute read about what happens when you’re denied a credit card. The two most important takeaways from the article are a) you can find out WHY you’ve gotten rejected, even if it is for a couple of reasons, and use that information to improve your chances or get on the phone with a representative and explain why their concerns are no longer warranted, and b) you will learn that a first rejection isn’t likely to hurt your future chances of getting a card, but many rejections can have that effect.

Pre-Tax Corner:

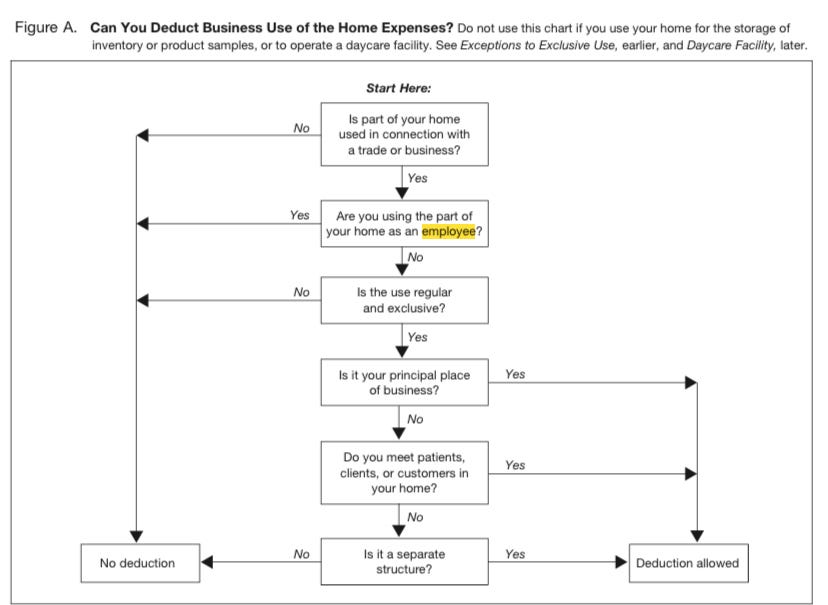

Does your “home-office” count towards your deduction?

When Covid-19 hit and offices closed, the commercial real-estate crew definitely got worried about their income streams. When I got sent to work from home, I thought to myself “Amazing, how much is the corner I commandeered in our apartment worth - gonna deduct it from my taxes!”

Alas, this is just not something someone who is employed by another company can do.

This useful chart below summarizes this concept. Again, I’m not dishing tax-advice, just sharing what I’ve found from friends and hope that it can help you too.

Takeaway:

Getting a credit card is daunting. It requires an application. It puts yourself out to the world. You can get rejected. Ultimately, though, your financial fitness will more likely than not be enhanced by getting access to credit that you otherwise will have a hard time developing in a world where you don’t have a credit card.

Interact:

If you don’t have a credit card, click some of the links above and pick one or two cards that you’ll apply for and let us know how it goes! We’re pulling for you.

If you already have a credit card, stay tuned for coming episodes of Winnings where I’ll cover some questions about “when should I NOT pay my entire credit card bill” and related items. I don’t think that will be in the next episode, but it will come soon!

Gratitude:

Thank you to Robert H. who came to the rescue when I was looking for someone to point me in the right direction to better understand the “home-office” deduction. If you’ve got pre-tax corner questions or points you want to share, send them over here!

What did you think of this note?

Awesome - Good - Solid - Eh - Bad

Check out my tweets about #Winnings and more @StartupRabbi

Please remember, I’m not providing professional advice about personal finance. I’ve got a lot of friends who do that and you can totally hit me up for an intro if you’d like - I don’t get any commission - just the happiness that my readers are taking their financial health seriously.