Intro:

This past week I was inspired by my wife Shoshi S.’s amazing work in assisting some members of our community to sign up for a Covid vaccine. These folks were less tech-savvy and needed some help, so she came to their rescue. I’m certain that I’m not on rescue level, but I do know that Vanguard (the trading platform) might have one of the least intuitive UX/UI (User Experience/User Interface) in the investing game.

Who can blame them? They’ve been at it for ages and through the complaints they still manage to garner some of the most investors in the long-term investing business.

Frankly, I’ve struggled with using their system a ton. Each time I log on I feel like I’m going to liquidate my assets or overdraft my checking account - not great feelings. For that reason, I decided to go through, step-by-step, the process of transferring money from my checking account to my IRA. While this might not be riveting stuff, I believe it’s worth it to take a look so you get encouraged to do it yourself.

How many steps does it take to make a deposit into your IRA?

Technically, I deposited the money into a Roth IRA, but do you have any idea how many jujitsu clicking moves it takes to make it happen? A lot. Follow along here:

You must start by going to Vanguard.com and logging into your account. I’ll count this as one step, but depending on your browser, you might need to do some fancy mouse-work to click into your appropriate account.

Take your mouse to hover over “My Accounts.”

Then you click “Account Overview” - here is where you see any accounts you have with Vanguard.

Click account you want to deposit money into. I clicked “Mr. Gabriel Weinberg Roth IRA” (for your account the name will likely be different).

Click “Contribute/Withdraw” - shockingly, this appears on its own line, which might make sense to some, but still struck me as a little odd.

Once you click that button, you see a dropdown menu. No comment here.

To continue in the right direction, you need to click “Contribute.”

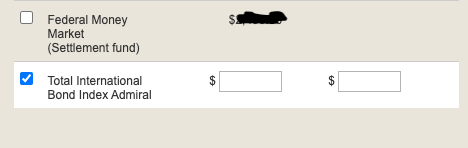

Click which account you want it to go to.

If you choose Federal Money Market, that money is invested at about the rate you’d have in a typical bank account. However, from that account you can purchase stocks, commodities, ETFs, and more. If you put the money into the Total International Bond Index Admiral, it’s like the name suggests, an investment into a host of non-American companies, governments, and securities. Read more about it here.

No matter which box you click, you need to type in the amount you want to contribute. If you recall the calendar, you’ve gotta deposit your 2020 contribution by Tax Day April 15, 2021 (UPDATE - I had a typo that said 2020, it’s not).

Make your your correct bank is selected. This is where the money you transfer to Vanguard will come from.

Click continue.

You then get directed to a pop-up that asks you to consent to “Electronic delivery of fund prospectus.” This is probably good for the trees, but annoying if you want to read the whole prospectus about what you bought.

Click Accept - unfortunately, you don’t seem to have much choice.

The grand finale: Click Submit.

Yes, it would take approximately 14 steps to contribute to your IRA. This number of steps might make you dizzy, but that’s why I put it here. Now you actually know that there is a way to do this, even if it feels supremely daunting when you click around for 5 minutes before finding the secret method to doing it. Trust me, I’ve been that person who can’t figure this out. I often write these notes to myself too - I generally receive and read them!

Pre-Tax Corner:

This isn’t a tip as much as a suggestion for a fun family activity. My family just scheduled our first ever family tax prep day. In short, we’ll get on Zoom across a few time zones, try to do our taxes, and have a nice time. The theory is that this will get us to submit our taxes on time. May I suggest you try this with your family? No need to share tax info, we’re not planning on that, but it’s a fun excuse to get together!

Takeaway:

UX/UI on Vanguard is poor. It probably shouldn’t take this many steps to contribute to your IRA, or even your regular brokerage account - I’m not 100% sure, but I’m confident it’s a similar series of steps. Additionally, it is not INFINITE so you can do it!

Interact:

You might not use Vanguard, so I apologize if this felt unnecessary, but my guess is that if you do have a brokerage account with IRA powers it might take a few steps to get money into it. I recommend taking a few minutes to make sure you know how to do it. If you do figure it out, please share with me what brokerage you use and how many steps it takes! Feel free to email me or reply via the comments.

Heads up:

Next week there will be no note as I’ll be traveling out of town for some vacation time. Do send in any questions you want me to cover in future episodes!

What did you think of this note?

Awesome - Good - Solid - Eh - Bad

Check out my tweets about #Winnings and more @StartupRabbi

Please remember, I’m not providing professional advice about personal finance. I’ve got a lot of friends who do that and you can totally hit me up for an intro if you’d like - I don’t get any commission - just the happiness that my readers are taking their financial health seriously.